Depreciation Schedule for Investment Property Guide

- Jul 1, 2025

- 17 min read

When you hear about a depreciation schedule for an investment property, think of it as your secret weapon for serious tax savings. It's a detailed report, put together by a specialist quantity surveyor, that maps out exactly how much you can claim as your property and the assets inside it get older.

Frankly, it's one of the best tools for unlocking thousands in tax deductions the Australian Taxation Office (ATO) allows property investors to claim.

Your Guide to Property Depreciation Deductions

As an Australian property investor, getting your head around depreciation is one of the smartest financial moves you can make. It’s a powerful way to boost your cash flow and shrink your tax bill each year.

The best part? Unlike other expenses where you have to physically spend money to claim a deduction, depreciation is what we call a non-cash deduction. You're simply claiming the value lost through normal wear and tear on your building and its fittings—no new spending required.

At its heart, a depreciation schedule for an investment property is a comprehensive forecast. It meticulously itemises everything you can claim, not just for one year, but often for the entire life of the property (up to 40 years). This schedule is the key to filling out your tax return correctly and making sure you’re not leaving money on the table.

The Two Pillars of Depreciation

The ATO breaks depreciation claims into two distinct categories. Understanding the difference is crucial to seeing the full picture of your potential savings.

Capital Works (Division 43): This is all about the building's structure. We're talking about the big-ticket items like the foundation, walls, roof, and other permanent fixtures such as built-in cupboards and tiling. You can generally claim these at a rate of 2.5% per year for up to 40 years.

Plant & Equipment (Division 40): This covers all the removable or mechanical assets inside the property. Think of things like carpets, blinds, ovens, air conditioners, and even the hot water system. These items have a shorter lifespan, so they depreciate much faster.

To make it a bit clearer, here’s a quick comparison of the two.

Capital Works vs Plant and Equipment At a Glance

Attribute | Capital Works (Division 43) | Plant & Equipment (Division 40) |

|---|---|---|

What it covers | The building's structure and permanent fixtures (walls, roof, foundations). | Removable or mechanical assets (carpets, appliances, air con). |

Depreciation Rate | Typically 2.5% per year (prime cost method). | Varies based on the asset's 'effective life'. Can be much higher. |

Claim Period | Up to 40 years. | The effective life of the individual asset (e.g., 5-15 years). |

Biggest Impact | Provides steady, long-term deductions over decades. | Generates larger deductions in the first few years of ownership. |

Getting a grip on these two categories is the first step to really optimising your tax return.

Expert Tip: A classic mistake investors make is underestimating the value locked up in Plant & Equipment. While the building's structure offers a slow and steady deduction, the assets inside it often deliver a much bigger financial punch in the early years of your investment.

Maximising Your Claims

Getting a professionally prepared schedule is non-negotiable. If you want to dive deeper into the nuts and bolts of how these deductions work, our detailed article on [depreciation on an investment property](https://www.baronaccounting.com/post/depreciation-on-investment-property) is a great place to start. It’ll arm you with the knowledge to have a more informed chat with your accountant.

Beyond the schedule itself, there are many strategies to maximize property deductions that can help you get the most out of your investment.

Ultimately, it’s about turning your property into a more financially efficient asset. By properly claiming depreciation, you directly lower your taxable income, which can make a huge difference to your annual cash flow and make holding onto the property that much easier. It's a must-have strategy for any serious investor.

Getting to Grips with the ATO's Rules and Dates

When you're dealing with depreciation schedules, you absolutely have to play by the Australian Taxation Office (ATO)'s rules. It might sound a bit dry, but understanding a couple of key dates is non-negotiable. Getting this right isn’t just about ticking boxes for compliance; it’s about legally squeezing every last dollar out of your tax deductions, which can add up to thousands each year.

The ATO's whole system for depreciation hinges on specific cut-off dates. For property investors, two dates, in particular, are absolute game-changers. Think of them as lines in the sand that sort properties into different depreciation buckets.

The 1987 Rule for Capital Works

The first date every Aussie property investor should have etched into their memory is 15 September 1987. This is the bedrock rule for claiming Capital Works deductions—the stuff that relates to the building’s actual structure, like the bricks, concrete slab, roof, and framework.

It’s pretty straightforward:

If construction on your residential property kicked off after 15 September 1987, you can almost certainly claim Capital Works deductions. This is calculated at 2.5% per year based on the original construction cost, for up to 40 years.

If your property was built before this date, you generally can't claim these deductions on the original structure.

This is exactly why a property's age is such a big deal. A place built in 1990 is a shoo-in for these claims, but one from 1985 is out of luck—at least for its original build. But here’s a common mistake people make: assuming an older property means zero deductions. Even if the original structure doesn't qualify, any renovations or big improvements made after the 1987 cut-off can often still be claimed.

Here’s a real-world example: Sarah buys an investment property built back in 1980 and initially assumes she’s missed the boat on Capital Works. But when she gets a quantity surveyor in, they uncover that the previous owner added a huge extension in 1995. Suddenly, Sarah can claim depreciation on the construction cost of that extension, unlocking thousands in deductions she thought were gone forever.

The 2017 Shake-Up for Plant & Equipment

The second critical date is much more recent: 9 May 2017. This is the day the government completely changed the game for claiming depreciation on Plant & Equipment assets in second-hand residential properties. We're talking about the removable items here—things like ovens, carpets, blinds, and air-con units.

Here’s how the rules changed:

If you signed the contract on a second-hand residential property after 7:30 PM (AEST) on 9 May 2017, you can no longer claim depreciation on any of the existing Plant & Equipment assets that were already in the house. You can only start claiming once you buy and install brand-new assets yourself.

If you bought the property before this date and time, you’re in luck. You were "grandfathered" under the old rules, so you can keep claiming depreciation on all the existing assets until they reach the end of their effective life.

This legislation was a massive shift. For investors buying established properties today, it means a huge chunk of potential deductions from existing fittings is off the table. This makes it more important than ever to properly identify and value any new assets you add.

Why These Dates Matter So Much

These dates aren't just plucked from thin air; they're anchored in Australian tax law. The rules are shaped by how properties are treated under Division 43 (for Capital Works) and Division 40 (for Plant & Equipment). For any property built after 15 September 1987, investors get to claim construction costs over that 40-year period. The 9 May 2017 change, however, was specifically aimed at second-hand residential properties, ensuring only the original owner or buyers of new assets could claim the depreciation on them.

Getting these dates right is absolutely paramount for creating a compliant and effective depreciation schedule. A good quantity surveyor lives and breathes these rules and will apply them to your unique property, ensuring you claim every cent you're entitled to without waving any red flags at the ATO. If you ignore these dates, you're almost guaranteed to be either under-claiming or over-claiming—and both are costly mistakes you don't want to make.

Why a Quantity Surveyor Is Your Best Investment

Tempted to create your own depreciation schedule to save a few dollars? I get it, but it's a non-starter with the Australian Taxation Office (ATO). The rules are black and white: a depreciation schedule for an investment property has to be prepared by a qualified professional.

That’s where quantity surveyors come in. The ATO specifically recognises them as the experts for estimating construction costs and valuing assets for depreciation. This isn’t just red tape; it’s your secret weapon for getting the biggest possible tax return. A good quantity surveyor does more than just fill out a form—they uncover hidden value you'd almost certainly miss on your own.

The Role of a Quantity Surveyor

Think of a quantity surveyor as a financial detective for your property. Their job is to carry out a meticulous on-site inspection, hunting down every single depreciable asset. We’re talking about everything from the obvious stuff, like ovens and air conditioners, to the easily overlooked items like ducting, wiring, and even the original architect's fees.

They zero in on two key areas:

Capital Works (Division 43): This is the building's structure itself. A quantity surveyor is trained to accurately estimate what it cost to build, even if the property is decades old and the records are long gone. This is a specialised skill that accountants and property owners just don't possess.

Plant and Equipment (Division 40): They create a detailed list of every eligible fixture and fitting, assigning a value and an effective life to each one. This ensures you’re claiming the maximum deduction allowed each and every year.

Their expertise is invaluable, especially if you're looking at renovation plans that add value to your investment. They ensure no stone is left unturned, and their comprehensive report is a legally sound document that will stand up to any ATO scrutiny.

Viewing the Fee as a High-Return Investment

It’s completely normal to baulk at an upfront cost. But honestly, paying for a quantity surveyor's report is one of the smartest investments a property owner can make. This isn't just another bill; it’s a tool for generating significant, ongoing tax savings.

A professionally prepared schedule typically costs between $300 and $800. While that might seem like a lot, it’s designed to unlock thousands of dollars in tax savings annually, year after year.

The Ultimate Benefit: The entire fee you pay for the depreciation schedule is 100% tax-deductible in the financial year you pay it. This immediately reduces the net cost, making the decision even easier.

When you weigh the thousands of dollars in deductions the report will find over the life of your property, the initial outlay is tiny. Not getting a schedule is like choosing to overpay your taxes, every single year.

Choosing the Right Professional

When you're looking for a quantity surveyor, don't just go for the cheapest quote. You need a firm that has a solid track record in tax depreciation specifically for residential properties.

Here’s a quick checklist of what to look for:

Experience: How long have they specialised in tax depreciation schedules?

ATO Compliance: Do they guarantee their reports are fully compliant with current ATO rulings?

Thoroughness: Do they insist on a physical inspection of the property? A desktop assessment will always leave money on the table.

The right schedule can also be a game-changer for strategies like negative gearing. By maximising your non-cash deductions through depreciation, you can reduce your on-paper loss, making the property much more affordable to hold.

Ultimately, hiring a qualified quantity surveyor isn't optional for a serious property investor—it's fundamental. It’s a one-off, tax-deductible fee that pays for itself many times over by ensuring you get the maximum tax benefits for decades.

So, you've got that detailed report from your quantity surveyor. It's more than just a list of assets and numbers; it's a strategic fork in the road. The Australian Taxation Office (ATO) gives you two distinct paths for calculating depreciation on your plant and equipment, and your choice here can really shape your investment's cash flow. This is where you shift from just receiving data to actively steering your tax strategy.

The two approved methods are the Prime Cost method and the Diminishing Value method. Once you pick a method for an asset, you're stuck with it for its entire effective life. Making the right call from the start is crucial to align your tax claims with your long-term goals for the property.

The Diminishing Value Method: Front-Loading Your Deductions

The Diminishing Value (DV) method is, without a doubt, the more popular choice, and for good reason. It lets you claim more depreciation in the early years. This method works by calculating the deduction on the asset's remaining value each year, which means your claims are biggest at the start and get smaller over time.

Think about it this way: a shiny new air conditioner loses more of its value in its first year than it does in its fifth. The DV method mirrors this real-world value drop, giving you a bigger tax kickback right when you probably need the cash flow most. It’s perfect for investors wanting to maximise their tax refund early on, helping to offset those initial holding costs and improve returns from day one.

A new dishwasher that cost you $1,200 with a 10-year effective life, for example, would generate a much larger deduction in Year 1 using the DV method compared to the alternative.

The Prime Cost Method: A Steady and Predictable Approach

On the flip side, we have the Prime Cost (PC) method, which some people call the straight-line method. It’s all about consistency. It calculates depreciation by spreading the asset's cost evenly over its entire effective life. The result? The exact same deduction amount, year in, year out.

For that same $1,200 dishwasher, the PC method gives you a clean $120 deduction every single year for ten years. Simple. This approach is often favoured by investors who prefer a stable, easy-to-forecast tax deduction. If you're in a high-income bracket and expect to stay there for the long haul, this can be a smart move to ensure a consistent level of deductions over time.

Key Takeaway: The choice between Diminishing Value and Prime Cost is purely strategic. Do you want to maximise cash flow now to help with the mortgage and other bills (Diminishing Value)? Or do you prefer a stable, predictable deduction for long-term planning (Prime Cost)?

Getting the asset values and claim rates right from the get-go is vital to avoid common mistakes when setting up your schedule.

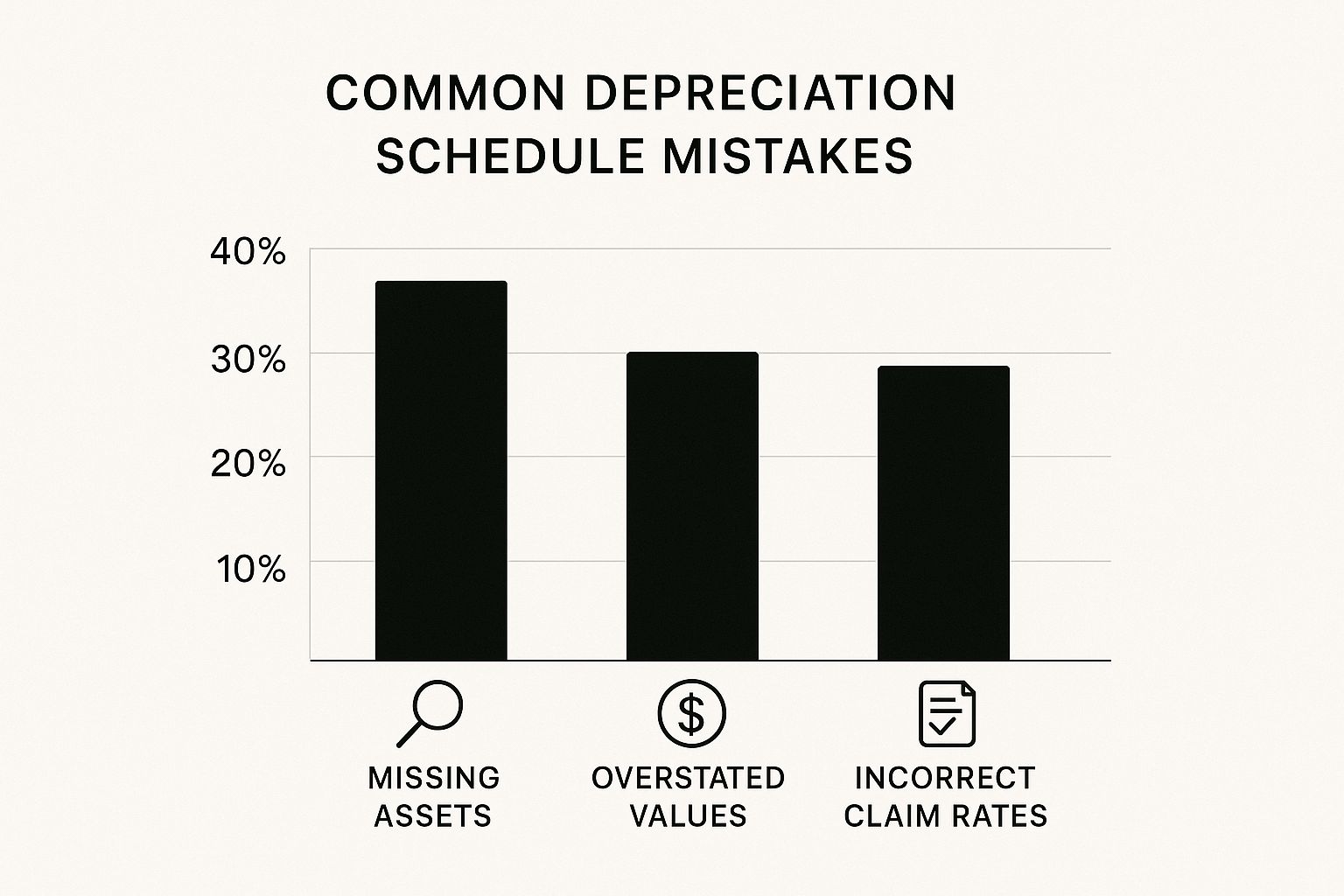

This chart shows some of the most frequent errors investors make when lodging their claims, highlighting why getting professional advice is so important.

As you can see, a huge chunk of errors comes from missing assets or using the wrong values and rates. Choosing the right calculation method is the first step, but applying it correctly is what counts.

A Side-by-Side Comparison

Let's crunch some numbers to see how this plays out in the real world. Imagine you just installed a new split system air conditioner costing $3,000 with an effective life of 10 years.

Here's a quick look at how the deductions would stack up in the first few years.

Prime Cost vs Diminishing Value Method Example (Asset Cost $3,000)

Year | Diminishing Value Deduction | Prime Cost Deduction |

|---|---|---|

Year 1 | $600 | $300 |

Year 2 | $480 | $300 |

Year 3 | $384 | $300 |

Total (3 Years) | $1,464 | $900 |

The difference is pretty stark. After just three years, the Diminishing Value method has put an extra $564 worth of deductions in your pocket. That's real cash that could go towards paying down your loan, funding minor repairs, or just improving your overall financial position.

Of course, the total claim over the asset's full 10-year life will be the same ($3,000) no matter which method you choose. It's all about the timing.

Your quantity surveyor's report will typically lay out the figures for both methods, making it easy for you and your accountant to make the final call. The right choice really comes down to your personal financial situation, your income, and your overall investment strategy. There’s no single "best" method—only the best method for you.

Costly Depreciation Mistakes and How to Avoid Them

It’s a painful truth, but even savvy property investors can leave thousands of dollars on the table by making simple, yet costly, mistakes with their depreciation claims. A properly prepared depreciation schedule for an investment property is a powerful financial tool, but it's easy to undermine its effectiveness through common myths and oversights.

Navigating the world of property tax can feel overwhelming. The good news is that avoiding these frequent blunders is actually quite straightforward once you know what to look for. By sidestepping these traps, you can protect your investment’s returns and ensure you’re claiming every dollar you're legally entitled to.

The Myth of the "Too Old" Property

One of the most stubborn—and expensive—myths out there is that an older property is simply "too old" to have any depreciation value left. Many investors incorrectly assume that if a building was constructed before the critical 1987 cut-off for Capital Works, there’s nothing left to claim. This couldn't be further from the truth.

While you might not be able to claim the original structure, a property of any age is filled with Plant and Equipment assets (Division 40). Think about it: carpets, ovens, hot water systems, and blinds all have a depreciable value. On top of that, a skilled quantity surveyor can identify and estimate the value of past renovations, which you can also claim.

Key Insight: Never write off a property based on its age alone. Significant value is often hiding in plain sight within renovations and existing assets, which only a professional site inspection can properly uncover.

The Pitfall of DIY Depreciation Schedules

Tackling your own depreciation schedule is a classic financial misstep, and for two very important reasons. First and foremost, the Australian Taxation Office (ATO) simply does not recognise self-assessed schedules for construction costs. They have a strict requirement that these valuations must be performed by a qualified quantity surveyor.

Secondly, you will almost certainly miss out on significant deductions. A quantity surveyor has the trained eye and expertise to identify hundreds of depreciable items—from the exhaust fans to the door closers—that the average person would naturally overlook. The difference between a DIY attempt and a professional report can be massive.

Just look at the numbers. Research from industry specialists shows the gap clearly. In one financial year, the average depreciation deduction found by professionals for their clients was around $8,845. In stark contrast, the average claim lodged directly by investors was only $3,748. This shows just how much value a professional can unlock. You can read more about these property investment statistics to see the full picture.

Forgetting to Update Your Schedule After Renovations

A depreciation schedule isn't a "set and forget" document, especially if you're improving your property. So many investors make the mistake of completing a major renovation and then completely forgetting to update their schedule.

New Kitchen: All the new appliances, the cabinetry, and even the plumbing have a depreciable value.

Bathroom Upgrade: That new tiling, the vanity, the toilet, and all the fixtures are claimable assets.

New Deck or Pergola: These additions fall under Capital Works and can be added to your depreciation claim.

When you don't get your schedule amended, you're missing out on claiming depreciation on all these new, high-value assets. It is absolutely crucial to contact your quantity surveyor after any capital improvements to have these new items assessed and added to your report. This ensures your claims stay maximised, year after year.

For a deeper dive, our guide on tax deductions for rental properties covers what expenses you can claim in more detail.

Putting Your Depreciation Knowledge into Action

Alright, you've got the theory down. Now, it's time to turn that knowledge into real, tangible savings.

A professionally prepared depreciation schedule for an investment property is easily one of the most powerful tools in an investor's arsenal. I see it time and time again: it's what separates a good investment from a great one by boosting your cash flow and shrinking your tax bill. Honestly, it's not an optional extra—it’s an essential part of a smart financial strategy.

The game plan is simple. You get a handle on the core ATO rules, bring in a qualified quantity surveyor to do the heavy lifting, and then apply the figures from their report when you do your taxes. It’s a single move that transforms your property from just sitting there into a financially efficient workhorse.

Taking the Next Step

I know what you might be thinking—another upfront cost? But the fee for a quantity surveyor is a drop in the ocean compared to the significant, ongoing tax benefits you’ll unlock year after year. Think of it as a small investment that pays for itself many times over by making sure you claim every single dollar you're entitled to.

And for managing those numbers long-term, it's worth getting familiar with modern tools. For those who like to stay organised, learning about utilizing asset depreciation software can be a real game-changer.

If you take away one thing, let it be this: a depreciation schedule is your key to unlocking your property's full financial potential. It directly lowers your taxable income, which means more money stays in your pocket every year.

This whole process is a crucial piece of your overall tax puzzle. To see how it fits into the bigger picture, have a look at our guide on the modern Australian tax return process with the ATO. Taking this step ensures your investment is working just as hard for you as you did for it.

Need an Expert to Look Over Your Numbers?

Figuring out a depreciation schedule can feel like you're wading through tax jargon. It's complex, but getting it right is one of the smartest moves an investor can make. Our team lives and breathes this stuff, and we're here to make sure you're not just compliant, but that you're getting every dollar back that you're entitled to.

And if you're keen to find other ways to give your refund a healthy boost, we've put together some of our best advice in another guide. You can check out our expert tips to maximise your tax return in Australia.

Got Questions? We've Got Answers

When you're digging into the world of property investment, depreciation schedules can seem a bit tricky. It’s a topic that brings up a lot of questions for both new and seasoned investors. Let's tackle some of the most common ones we hear, so you can move forward with confidence.

How Long Does a Depreciation Schedule Last?

This is one of the best parts. A professionally prepared depreciation schedule is not a yearly expense. It's a one-off report that lasts for the entire depreciable life of the property’s assets, which can be up to 40 years for the building's structure (what the ATO calls Capital Works).

You simply hand the same report to your accountant each year at tax time. The only time you’d need an update is if you make a significant capital improvement, like a full kitchen renovation or adding a deck. If that happens, you just give your quantity surveyor a call to assess the new work and add it to your existing schedule.

Can I Claim Depreciation on an Old Property?

Absolutely, yes. This is easily one of the biggest and most expensive mistakes an investor can make. Even if your property was built before the 1987 cut-off for claiming the original construction costs, it's almost certainly full of value you can still claim.

A property's age should never be a reason to skip a depreciation schedule. The real value is often hiding in plain sight—in the Plant & Equipment assets like ovens, carpets, and air conditioners, and any renovations done after 1987. A quantity surveyor knows exactly how to find and value these items.

An older house will still have plenty of depreciable assets. Better yet, any renovations or updates made by previous owners after that key 1987 date can be estimated by a quantity surveyor and included in your claim. You don't have to miss out.

Is the Fee for a Depreciation Schedule Tax Deductible?

It sure is. The fee you pay a qualified quantity surveyor to prepare your schedule is 100% tax-deductible. This makes the decision to get one a real no-brainer from a financial perspective.

You can claim the entire cost as a professional service fee in the same financial year you pay for it. This deduction immediately lowers the net cost of the report, making it one of the highest-returning investments you can make for your property.

Do I Need a New Schedule If I Refinance?

Nope. Refinancing your investment property loan has zero impact on your depreciation schedule. Depreciation is all about the physical asset's cost and its effective life, not the loan you have attached to it.

A couple of things to keep in mind, though:

Loan Costs: Any fees you pay to set up the new loan, like application or establishment fees, might be deductible over several years. But this is a separate claim from your property depreciation.

No Change to Assets: Refinancing doesn't change the building or the assets inside it, so your existing schedule is still perfectly valid and accurate.

Essentially, your schedule is tied to the bricks and mortar, not the mortgage.

• Need assistance? We offer free online consultations: – Phone: 1800 087 213 – LINE: barontax – WhatsApp: 0490 925 969 – Email: info@baronaccounting.com

– Or use the live chat on our website at www.baronaccounting.com

📌 Curious about your tax refund? Try our free calculator: 👉 www.baronaccounting.com/tax-estimate

For more resources and expert tax insights, visit our homepage: 🌐 www.baronaccounting.com

Comments